Saving money as a student feels tough, but you can take charge of your financial future. Many students face real challenges—

- 61% report financial stress hurting their education

- 59% have even thought about dropping out because of money problems

You don’t have to be part of those statistics. Start building good habits now. Create a budget, set up an emergency fund, and focus on your financial goals. Early financial literacy gives you skills for budgeting, saving, and managing debt. Check out money-saving secrets, and don’t leave financial aid or scholarships on the table. When you make smart choices today, you set yourself up for a stronger tomorrow.

| Aspect of Financial Literacy | Impact on Long-term Financial Health |

|---|---|

| Financial Practices Modeled | Youth emulate both positive and negative financial behaviors from caregivers, influencing their future financial decisions. |

| Financial Literacy Training | Early training helps youth understand key concepts like saving and budgeting, leading to better financial habits. |

| Family Discussions | Encouraging discussions about money management within families fosters responsible financial behaviors. |

Key Takeaways

- Create a budget to track your income and expenses. This helps you avoid overspending and manage your finances effectively.

- Set clear financial goals to stay motivated. Specific targets, like saving a certain amount by a deadline, can boost your savings efforts.

- Take advantage of financial aid and scholarships. Apply early and often to maximize your chances of receiving support for your education.

- Use student discounts and campus resources to save money. Many services and discounts are available that can help reduce your costs.

- Start an emergency fund to prepare for unexpected expenses. Aim for at least $1,000 to provide a financial safety net.

Money-saving Secrets for Students

Building a Student Budget

You might think budgeting sounds boring, but it’s actually one of the best money-saving secrets you can use as a student. A good budget helps you see where your money goes and keeps you from overspending. Start by listing your income—maybe from a part-time job, allowance, or financial aid. Next, write down your monthly expenses, like rent, groceries, and transportation.

Here are some practical budgeting methods students use to manage monthly expenses:

- Evaluate your spending on wants and set reasonable monthly limits.

- Reduce spending on things you don’t need, at least for a while.

- Try side hustles if you want to boost your income.

Many students find success with zero-based budgeting. This means you give every dollar a job, so nothing gets wasted. You can also use budgeting apps like Mint or You Need a Budget, or even simple tools like Microsoft Excel or Google Sheets. Some banks offer built-in budgeting tools, so check what your bank provides.

Tip: Overspending is a common mistake. If you create a monthly budget and stick to it, you’ll avoid running out of money before the month ends.

Tracking Expenses Easily

Tracking your expenses doesn’t have to be a hassle. When you know exactly where your money goes, you can spot patterns and make smarter choices. Many students use apps to keep things simple and organized.

Popular tools for tracking daily expenses include:

- Fudget: A simple app for listing income and expenses.

- Rocket Money: Automatically tracks your spending and subscriptions.

- GoodBudget™: Lets you use digital envelopes for different categories.

- EveryDollar: Helps you plan every dollar with zero-based budgeting.

- Debt Payoff Planner: Guides you in creating a debt repayment plan.

You can also use Microsoft Excel or Google Sheets for online tracking. Money-saving apps like EveryDollar make it easy to see your progress. If you prefer pen and paper, that works too—just make sure you record every purchase.

Note: Many students forget about small purchases, like coffee or snacks. These add up fast! Tracking every expense helps you stay on top of your budget.

Setting Financial Goals

Setting clear financial goals is one of the most powerful money-saving secrets. When you know what you’re saving for, you’ll feel more motivated to stick to your plan. Maybe you want to save for a spring break trip, a new laptop, or just build up your emergency fund.

Research shows that setting specific financial goals actually helps students save more. In fact, the impact of having goals is even stronger than just learning about money. So, take a few minutes to write down your goals. Make them specific and realistic. For example, instead of saying, “I want to save money,” try, “I will save $500 by the end of the semester.”

Here’s a simple way to set your goals:

- Decide what you want to achieve (like saving for textbooks or an emergency fund).

- Figure out how much you need.

- Break it down into smaller steps—how much will you save each week or month?

- Track your progress and celebrate small wins.

Callout: Many students neglect emergency savings, but having a small fund can save you from big problems later. Start with a goal of $100 or $200 and build from there.

If you pay yourself first—meaning you put money into savings before spending on other things—you’ll reach your goals faster. This habit will help you avoid common mistakes, like overspending or not having money for emergencies.

By building a budget, tracking your expenses, and setting clear goals, you’ll unlock money-saving secrets that can make your student life less stressful and more rewarding.

Maximizing Financial Aid and Scholarships

Paying for college can feel overwhelming, but you have more options than you might think. Financial aid and scholarships can cut your tuition costs and help you avoid student debt. When you use these resources, you unlock some of the best money-saving secrets for students.

Finding Financial Aid Opportunities

You can find financial aid from several sources. Each one offers different types of support, so it pays to explore all your options.

- Grants: Free money you don’t have to pay back, like the Federal Pell Grant.

- Scholarships: Awards based on your achievements, talents, or financial need.

- Work-study: Part-time jobs that help you earn money while you study.

- Loans: Money you borrow and must repay with interest.

You can get financial aid from the federal government, your state, or your college. The federal government uses your FAFSA information to decide how much aid you get. States often help students who live and study in-state. Many colleges have their own funds, so check with your school’s financial aid office.

Tip: Fill out the FAFSA as soon as possible each year. Some aid is first-come, first-served, so don’t wait!

Scholarship Strategies and Application Tips

Winning scholarships can make a huge difference in your college costs. You can boost your chances by using smart strategies and staying organized. Here’s a table with top tips for scholarship success:

| Strategy | Description |

|---|---|

| Understand eligibility criteria | Read each scholarship’s rules to make sure you qualify before you apply. |

| Dedicate time to the application | Set aside time every week to work on applications and avoid last-minute stress. |

| Prepare necessary documents | Gather your transcripts, letters, and other papers early so you’re ready to apply. |

| Showcase extracurricular involvement | Highlight your clubs, sports, or volunteer work—scholarship committees love well-rounded students. |

| Highlight special talents | Share your unique skills, like art, music, or athletics, if the scholarship values them. |

| Use online scholarship databases | Search for scholarships on websites that match you with opportunities based on your profile. |

| Create a versatile personal essay | Write a strong personal statement you can tweak for different scholarships. |

You don’t have to wait for senior year to start applying. Many scholarships open as early as freshman year and continue through college. Apply for as many as you can, even if the award seems small. Every dollar helps!

Alert: Don’t ignore local scholarships. Community groups, businesses, and even your high school may offer awards with less competition.

Organizing Deadlines and Documents

Staying organized can help you avoid missing out on free money. Here’s a simple step-by-step way to keep your scholarship applications on track:

- Create an account on your school’s scholarship portal or a trusted scholarship website.

- Browse available scholarships and pick the ones that fit you best.

- Complete the main application to unlock a list of scholarships you can apply for.

- Review each opportunity and submit all required information, like essays or recommendation letters.

- Upload your FAFSA Student Aid Index and any other documents before the deadline.

You can use a calendar, planner, or even a spreadsheet to track deadlines and requirements. Set reminders so you never miss an important date.

Note: Keep digital copies of your essays, transcripts, and recommendation letters. This makes it easy to apply for more scholarships quickly.

When you stay organized and apply for aid year-round, you give yourself the best chance to save money and reduce stress. These money-saving secrets can help you focus more on your studies and less on your bills.

Smart Ways to Cut Student Costs

Saving on Textbooks and Supplies

Textbooks can eat up your budget fast, but you have options. You can compare prices on sites like ThriftBooks or Amazon. Renting textbooks or buying used copies saves a lot. Sometimes, older editions work just as well—ask your professor if you can use one. Many professors also know about free PDFs or open-source materials. You can even Google the textbook name to find free versions.

Here are some smart ways to save on textbooks and supplies:

- Check your college library for reserved copies.

- Share books with friends or roommates.

- Pair up with a friend to buy different textbooks and trade.

- Sell your textbooks at the end of the semester.

- Look for textbook scholarships from retailers.

Tip: Always ask your professor if you can use a previous edition or if they know about free resources.

Affordable Food Choices

Eating well on a budget is possible. Start by planning your meals ahead of time. This helps you avoid impulse buys and keeps you on track. Buy staples like rice, pasta, oats, and beans in bulk. Store brands often cost less and taste the same as name brands. Farmers’ markets offer fresh produce at good prices.

Some affordable and healthy foods include:

- Beans—great for salads, soups, and wraps.

- Lentils—perfect for stews and curries.

- Eggs—cheap and versatile.

- Tofu—excellent for stir-fries.

- Canned fish—easy to add to pasta or salads.

Meal prepping at the start of the week helps you stick to your budget and eat healthier.

Reducing Housing Expenses

Housing costs can be high, but you can cut them down. Living at home while attending community college saves thousands. Online learning can help you skip housing costs altogether. If you need to live near campus, sharing an apartment with roommates lowers rent and utilities. Off-campus housing is often cheaper than dorms. You can negotiate rent or look for sublets and discounts on social media.

Other ways to save:

- Become a Resident Assistant (RA) for free or discounted housing.

- Choose a college that allows off-campus living.

You can use these money-saving secrets to keep more cash in your pocket and stress less about bills.

Campus Resources and Student Discounts

Where to Find Student Discounts

You can stretch your budget by taking advantage of student discounts. Many companies want to help you save, so always ask if a student rate exists. Here are some popular discounts you should know about:

- Transportation: Amtrak gives you 15% off train tickets if you are between 17 and 24. New Jersey Transit offers 25% off monthly passes for eligible students. BYO Jet has special flight rates just for students.

- Technology: Adobe slashes 64% off Creative Cloud for students. Apple’s education store has special pricing on laptops and tablets. Dell also gives a percentage off sitewide when you verify your student status.

- Entertainment: AMC Theaters lets you buy discounted tickets with your college ID. Carnegie Hall sells $10 tickets for select shows. Universal Studios Hollywood offers discounted park passes if you attend a partner university.

Tip: Always carry your student ID. You never know when you’ll find a surprise discount!

Using Campus Services

Your campus offers a lot more than just classrooms. Many students miss out on free or low-cost services that can save you hundreds each semester. Check out this table to see what you might be missing:

| Service Type | Description |

|---|---|

| Health and Wellness Resources | Free or low-cost medical care, check-ups, and mental health counseling. |

| Library and Research Resources | Access to academic journals and textbooks—no need to buy expensive materials. |

| Campus Events and Activities | Free events for fun and learning, so you spend less on outside entertainment. |

| Campus Transportation | Free or discounted rides that help you save on gas and parking. |

| Campus Fitness Facilities | Free gym access and classes—no need for a pricey gym membership. |

| Career Development Center | Career counseling and networking, boosting your job search at no extra cost. |

| Food Pantries | Free groceries and essentials to help with tight budgets. |

| Counseling Centers | Free or low-cost counseling and wellness workshops for your mental health. |

Note: Visit your campus website or student center to learn how to access these services.

Free and Low-cost Entertainment

You don’t have to spend a lot to have fun in college. Your campus and community offer plenty of free or cheap ways to relax and connect with friends:

- University events like concerts, art shows, and festivals often have free admission.

- Many museums and cultural spots offer student discounts or free days.

- Organize game nights or movie marathons with friends for a fun night in.

- Enjoy the outdoors with picnics or join a campus sports game.

- Join student clubs—most events are included in your membership.

- Host tournaments, try bird watching, or plan karaoke nights using YouTube.

- Explore free online courses or virtual workshops for entertainment and learning.

Callout: The best memories often come from simple, low-cost activities. Get creative and make the most of what’s around you!

Low-risk Investments for Students

You don’t need a finance degree to start investing safely as a student. You can grow your money with simple, low-risk options that protect your savings and help you reach your goals. Let’s break down the best ways to get started.

High-yield Savings Accounts

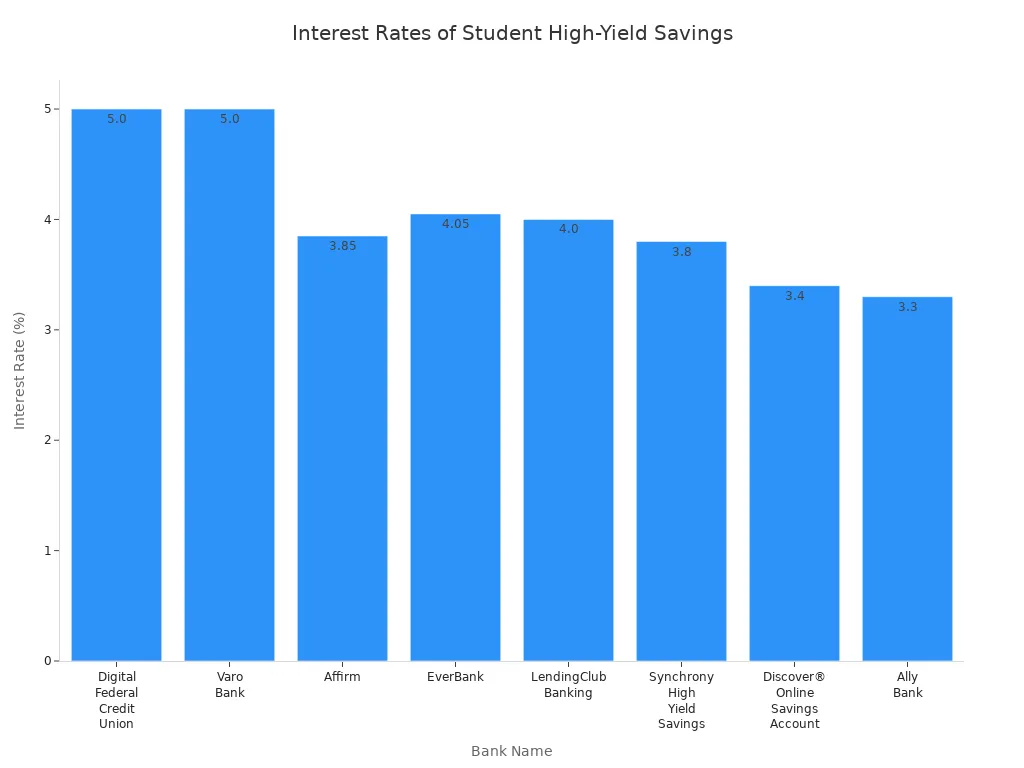

A high-yield savings account gives you a much better interest rate than a regular savings account. You can open one online with just a few dollars. Many banks offer no monthly fees and no minimum balance. Check out this table to compare some top options:

| Bank Name | Interest Rate | Minimum Deposit | Features |

|---|---|---|---|

| Digital Federal Credit Union | 5.00% | $5 | High introductory APY, $5 minimum to open |

| Varo Bank | 5.00% | $0 | Potential to earn higher APY, No monthly fees |

| Affirm | 3.85% | $0 | Fantastic APY, Simple mobile app |

| EverBank | 4.05% | $0 | Great interest rate structure, Strong online bank |

| LendingClub Banking | 4.00% | $0 | Great APY, No monthly fees |

| Synchrony High Yield Savings | 3.80% | $0 | Good APY, No minimums or monthly fees |

| Discover® Online Savings | 3.40% | $0 | Good APY, No monthly or insufficient funds fees |

| Ally Bank | 3.30% | $0 | Well-rated online banking platforms, Forgiving fee structure |

Tip: Even small deposits can grow faster with a high-yield account. Start with what you have and add more when you can.

Roth IRAs and 529 Plans

You can use Roth IRAs and 529 plans to save for the future. Roth IRAs let you withdraw your contributions tax-free, which means you keep more of your money. 529 plans help you pay for college and can even cover up to $10,000 in student loan payments. If you don’t use all your 529 funds, you can roll them into a Roth IRA or use them for other family members.

- Roth IRAs: Tax-free withdrawals of contributions, great for long-term savings.

- 529 Plans: Pay for school, cover student loans, and roll over unused funds without penalties.

Callout: The earlier you start, the more you benefit from compounding interest.

Diversifying Investments

You don’t want to put all your eggs in one basket. Diversifying means spreading your money across different investments. You can use mutual funds, ETFs, or index funds to do this, even with a small amount of cash.

- Choose mutual funds, ETFs, or index funds for easy diversification.

- Think about your risk tolerance—are you cautious or willing to take a little risk?

- Stay updated on market trends.

- Don’t overdo it—too many investments can get confusing.

- Check your investments often and make changes if needed.

Note: Diversification helps protect your money if one investment doesn’t do well.

Starting an Emergency Fund

An emergency fund is your safety net. Aim for $1,000 to start, then work toward saving enough for three months of expenses. You can build your fund by setting a goal, making a budget, cutting costs, and finding ways to earn extra cash.

- Set a savings goal (start with $1,000).

- Make a budget and stick to it.

- Cut back on non-essentials.

- Look for side gigs or part-time work.

- Take a financial literacy course to boost your skills.

Alert: An emergency fund keeps you from going into debt when life throws you a curveball.

You can also try other low-risk options like Certificates of Deposit (CDs), money market funds, or Treasury securities. These choices give you steady returns and keep your money safe.

Emoji: 🚀 Start small, stay consistent, and watch your savings grow!

You have so many ways to take control of your finances as a student. Start with a budget, set clear goals, and use money-saving secrets like meal prepping and a dedicated savings account. Try visualization techniques or reward systems to stay motivated. Check out this table for more ways to boost your progress:

| Technique | How It Helps |

|---|---|

| Visualization Techniques | Keeps your goals in sight and boosts motivation |

| Accountability Partner | Gives you support and helps you stay on track |

| Track Progress | Shows your achievements and keeps you focused |

Explore campus resources, apply for scholarships, and invest early. You can build strong habits now that will pay off for years. Why not start today?

FAQ

How can I start saving money if I have a tight budget?

You can start small. Set aside just $5 or $10 each week. Use a budgeting app to track your spending. Look for free campus events and student discounts. Every little bit adds up over time!

What is the safest investment for students?

High-yield savings accounts and certificates of deposit (CDs) offer low risk. You can also try a 529 plan for education savings. These options keep your money safe while earning some interest.

How do I find scholarships that fit me?

Use online scholarship search engines like Fastweb or Scholarships.com. Check with your school’s financial aid office. Local businesses and community groups often offer awards. Make a list and apply to as many as you can.

What should I do if I miss a scholarship deadline?

Don’t stress! Many scholarships open throughout the year. Set reminders for future deadlines. Keep your documents ready so you can apply quickly next time.

Can I invest if I only have a small amount of money?

Yes! Many apps let you start investing with as little as $1. Try micro-investing platforms or open a Roth IRA. The key is to start early and stay consistent.