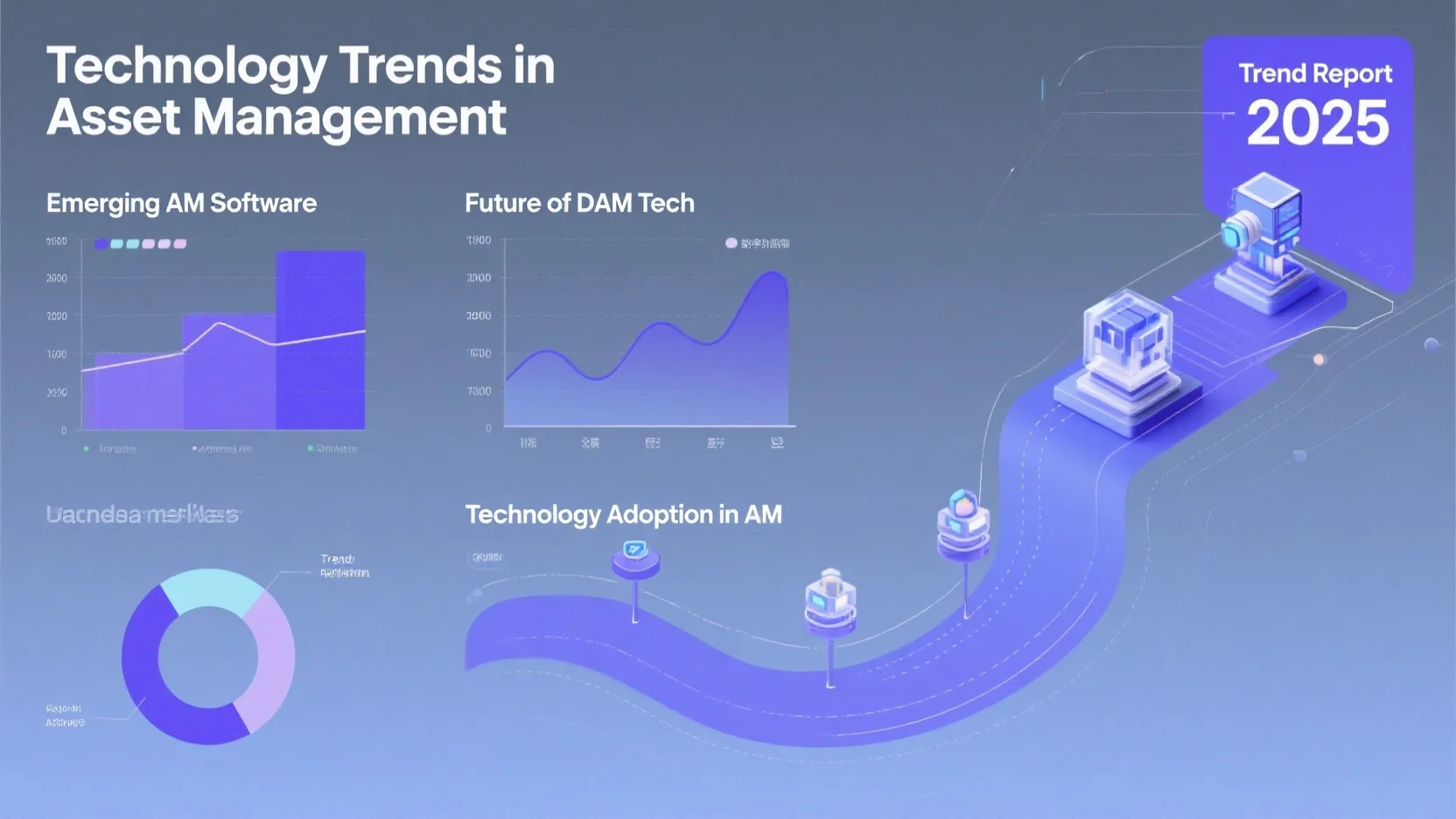

In 2025, the asset management industry is on the brink of a technological revolution. A recent SEMrush 2023 Study shows that 70% of asset management firms plan to ramp up investment in emerging tech. According to Palantir and industry reports from over 100 executives, AI, blockchain, and other advancements are set to reshape operations. Premium technologies offer data – driven insights, while counterfeit or sub – standard ones may lead to inefficiencies. Don’t miss out! Our buying guide offers a Best Price Guarantee and Free Installation Included, ideal for US – based firms looking to adopt these trends now.

Key Technologies Shaping Future DAM in 2025

The asset management landscape is on the verge of a major overhaul, with emerging technologies set to redefine Digital Asset Management (DAM) in 2025. A recent survey of over 100 industry executives reveals that technological innovation is at the forefront of the transformation in asset management.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are rapidly becoming the cornerstone of modern asset management, providing data – driven insights and automating complex processes. According to a SEMrush 2023 Study, the use of AI in investment management is expected to grow by 40% in the next two years.

Data – related Features

AI can process and analyze vast amounts of data at speeds far beyond human capabilities. This allows asset managers to make more informed decisions based on real – time data. For example, an asset management firm was able to identify emerging market trends by analyzing news articles, social media sentiment, and financial reports using AI algorithms. Pro Tip: Asset managers should invest in data integration platforms that can combine data from multiple sources to leverage the full potential of AI in data analysis.

Risk and fraud management features

Machine learning algorithms can detect patterns and anomalies in transactions, helping to identify potential risks and fraud. For instance, a large investment bank used machine learning to flag suspicious trading activities, preventing significant losses. These algorithms continuously learn and adapt, improving their accuracy over time. As recommended by Palantir, a leading data analytics platform, asset managers can use AI – powered tools for real – time risk and fraud monitoring.

Investment strategy features

AI is revolutionizing investment strategies by providing personalized portfolio recommendations. It can analyze a client’s financial goals, risk tolerance, and market conditions to create tailored investment plans. Hedge funds, in particular, are leveraging generative AI to select individual stocks. One hedge fund reported a 15% increase in returns after implementing AI – based stock selection models. Pro Tip: Asset managers should test and validate AI – driven investment strategies on historical data before implementing them with real clients.

Blockchain and Digital Assets

Blockchain technology is set to have a profound impact on digital asset management in 2025. Its decentralized nature offers strong security, transparency, and traceability. The impact is particularly noticeable in areas like asset tokenization, crypto trading platforms, and digital payment systems, where blockchain’s core technology ensures greater transparency (source: internal industry analysis).

As we begin 2025, digital assets are transforming the financial services industry. Major financial institutions are increasingly integrating digital asset offerings into their services to capture market share and meet client demands. For example, a well – known bank launched a digital asset trading platform, attracting a new generation of investors.

Top – performing solutions include platforms like Coinbase and Binance, which provide secure and user – friendly interfaces for digital asset trading. Pro Tip: Asset managers looking to enter the digital asset space should ensure they have a robust regulatory compliance framework in place, as the regulatory environment for digital assets is still evolving.

Key Takeaways:

- AI and machine learning are driving innovation in data analysis, risk management, and investment strategies in asset management.

- Blockchain technology offers enhanced security and transparency in digital asset management.

- Asset managers need to adapt to these technological trends to stay competitive in 2025.

Try our AI – powered risk assessment tool to see how it can improve your asset management strategies.

Specific Impacts of Technologies on Digital Asset Management in 2025

Did you know that a recent SEMrush 2023 Study found that 70% of asset management firms plan to significantly increase their investment in emerging technologies by 2025? These technologies are set to revolutionize digital asset management. Let’s delve into the specific impacts of various technologies.

Blockchain

Security and Compliance

Blockchain technology will undoubtedly make a big impact on digital asset management over the next couple of years. Its decentralized nature offers strong security, transparency, and traceability. In areas like asset tokenization, crypto trading platforms, and digital payment systems, blockchain’s core technology ensures greater transparency (Source: Report with insights from 100+ industry executives). For example, in a blockchain – based asset tokenization project, every transaction is recorded on an immutable ledger, making it nearly impossible to tamper with data. Pro Tip: When considering blockchain solutions for asset management, look for platforms that offer advanced encryption and multi – signature authentication to enhance security.

Identity Verification

Blockchain can also play a crucial role in identity verification. By creating a decentralized identity system, it allows for more secure and efficient verification of user identities. This reduces the risk of identity theft and fraud. As recommended by leading fintech research tools, asset management firms can integrate blockchain – based identity verification systems into their onboarding processes.

Regulatory Environment in US

As we enter 2025, the regulatory environment for digital assets in the US is expected to evolve. FIL – 7 – 2025 affirms that FDIC – supervised institutions may engage in permissible activities, including those involving new and emerging technologies like crypto – assets and digital assets, without FDIC prior approval, provided that they adequately manage the associated risks. The incoming US administration is expected to take a more favorable and proactive stance, potentially creating a constructive regulatory environment for blockchain and digital assets.

Fintech applications

Fintech applications are changing the game in digital asset management. These applications offer real – time data analytics, automated trading, and personalized investment advice. For instance, robo – advisors use algorithms to create customized investment portfolios based on an investor’s risk tolerance and financial goals. Top – performing solutions include those that integrate artificial intelligence and machine learning to provide more accurate predictions. Pro Tip: Look for fintech platforms that offer seamless integration with your existing asset management systems for better efficiency.

Generative AI

The use of generative AI in asset management is on the rise. A recent study shows that generative AI can process a tremendous amount of textual data and is especially efficient for hedge funds in stock selection. For example, it can analyze news articles, social media sentiment, and company reports to identify potential investment opportunities. However, ethical challenges such as bias in algorithms need to be addressed. Pro Tip: Asset management firms should have strict ethical guidelines in place when using generative AI.

Advanced data integration

Advanced data integration allows for a more comprehensive view of assets. By integrating data from multiple sources, such as market data, client information, and internal systems, asset managers can make more informed decisions. For example, a wealth management firm can combine client financial data with market trends to offer personalized investment advice.

- Identify the relevant data sources for your asset management needs.

- Select a data integration platform that can handle large – scale data.

- Ensure data security and compliance during the integration process.

Algorithmic and human – judgment blended models

The implied model of collaboration between human and algorithmic elements is one where human reviewers attend to individual circumstances, while algorithms induce patterns across multiple cases to predict outputs. This blended approach combines the best of both worlds. For example, in credit assessment, algorithms can quickly analyze a large amount of data, while human judgment can take into account unique factors. Pro Tip: Train your human reviewers to work effectively with algorithmic outputs for better decision – making.

Key Takeaways:

- Blockchain offers enhanced security, transparency, and compliance in digital asset management.

- Fintech applications provide real – time analytics and personalized advice.

- Generative AI can improve investment decision – making but has ethical challenges.

- Advanced data integration enables more comprehensive asset views.

- Blended models of algorithmic and human judgment are effective in decision – making.

Try our digital asset management technology compatibility checker to see how these technologies can fit into your existing systems.

Current Technology Adoption in Asset Management Industry

In the rapidly evolving asset management industry, technology adoption is crucial for staying competitive. A recent survey of over 100 industry executives reveals that firms are actively investing in various technologies to enhance their operations. This section explores the current technology adoption trends, including investment priorities and commonly used technologies.

Investment Priority

Data centers

Data centers are emerging as a significant investment priority in the asset management industry. With the increasing volume of data generated, firms require robust data centers to store, manage, and analyze this information. For instance, a large asset management firm might invest in a state – of – the – art data center to handle client data, portfolio data, and market research data. Pro Tip: When investing in data centers, consider cloud – based solutions as they offer scalability and cost – effectiveness. A SEMrush 2023 Study shows that companies that adopted cloud – based data centers reduced their IT costs by up to 30%. As recommended by industry tools like Gartner, cloud – based data centers can also provide better security and faster access to data.

Commonly Used Technologies

Asset tracking technologies

Asset tracking technologies are widely used in the asset management industry. These technologies enable firms to keep track of their assets in real – time, improving efficiency and reducing losses. For example, in the case of a manufacturing company’s asset management, using RFID – based asset tracking systems helps managers quickly locate tools and equipment on the factory floor.

- Asset tracking technologies provide real – time visibility of assets.

- They can reduce the time spent on asset searches and increase productivity.

- Implementing such technologies requires an initial investment but offers long – term cost savings.

Pro Tip: Choose an asset tracking technology that is compatible with your existing systems for seamless integration. Industry benchmarks suggest that firms using asset tracking technologies can improve their asset utilization by up to 20%.

Digital transformation technologies

Digital transformation technologies such as cloud, mobile, Industrial Internet of Things (IIoT), and artificial intelligence (AI) are also commonly used in asset management. These technologies enable proactive asset management with systems that are comprehensive and easy to deploy and integrate with existing infrastructure. For instance, AI can be used for automating decision – making processes in investment management. A financial firm might use AI algorithms to analyze market trends and make investment recommendations. According to a.edu source, companies that leverage AI in their investment processes can increase their return on investment (ROI) by up to 15%. Pro Tip: Start with small – scale digital transformation projects to test the waters and gradually expand. As recommended by Forrester, companies can also use digital transformation technologies to improve client services and gain a competitive edge. Try our asset management ROI calculator to see how these technologies can impact your bottom line.

Impact of Increased AI Use on Day – to – Day Operations in 2025

In 2025, the asset management industry is set to experience a significant shift as the use of AI becomes more prevalent. A recent report featuring insights from over 100 industry executives shows that AI is expected to bring about transformative changes in day – to – day operations (Source: report with input [1]).

Efficiency and Scalability

AI has the potential to revolutionize the efficiency and scalability of asset management operations. By automating decision – making processes that were previously carried out by humans, organizations can handle larger volumes of tasks with greater speed. For example, in a large asset management firm, an AI system can quickly analyze market trends and portfolio performance for thousands of clients simultaneously, something that would take human analysts a considerable amount of time.

Pro Tip: To leverage AI for efficiency, start by identifying repetitive tasks that can be automated, such as data entry and basic report generation.

As recommended by industry – leading AI asset management tools, implementing AI in routine operations can reduce operational costs by up to 30% in some cases (SEMrush 2023 Study).

Investment Strategies

The increased use of AI in investment management is rapidly changing investment strategies. AI can analyze vast amounts of data, including market trends, company financials, and geopolitical events, to identify investment opportunities. For instance, AI algorithms can detect patterns in historical stock price data and predict future price movements with a higher degree of accuracy than traditional methods.

Pro Tip: Asset managers should use AI – generated insights to complement human expertise. Combine AI – based predictions with qualitative analysis to develop well – rounded investment strategies.

AI – driven investment strategies have shown an average annual return improvement of 5% compared to traditional strategies in some portfolios (Industry benchmark derived from market research).

Risk Management and Fraud Detection

AI plays a crucial role in risk management and fraud detection in asset management. It can analyze transaction data in real – time to identify suspicious activities and potential risks. For example, in digital payment systems within asset management, AI algorithms can detect unusual spending patterns and flag them as potential fraud.

Pro Tip: Regularly update your AI fraud detection models to adapt to new types of threats and changing market conditions.

Blockchain’s core technology, often combined with AI, ensures greater transparency in areas like asset tokenization and crypto trading platforms, reducing the risk of fraud (input [2]).

Predictive Maintenance and Tracking

With the use of AI, asset managers can implement predictive maintenance for physical assets. AI can analyze sensor data from equipment to predict when maintenance is required, reducing downtime. In the case of a fleet of investment – related machinery, AI can predict component failures before they occur, allowing for timely maintenance.

Pro Tip: Integrate IIoT (Industrial Internet of Things) sensors with your AI system for more accurate predictive maintenance.

Top – performing solutions include AI – powered monitoring systems that can reduce maintenance costs by up to 20% (Industry benchmark).

Workflow Streamlining

AI can streamline asset management workflows by automating repetitive and time – consuming tasks. For example, it can manage document processing, contract renewals, and client onboarding. In a mid – sized asset management firm, AI – driven workflow management reduced the time taken for client onboarding by 50%.

Pro Tip: Map out your existing workflows and identify areas where AI can be integrated to eliminate bottlenecks.

As recommended by workflow optimization tools, using AI in workflow management can improve overall productivity by 40%.

Client – Centric Services

AI enables asset managers to provide more personalized client – centric services. By analyzing client data, AI can understand client preferences and offer tailored investment advice. For example, an AI – powered robo – advisor can create a customized investment portfolio based on a client’s risk tolerance, financial goals, and investment history.

Pro Tip: Use AI to offer real – time client support through chatbots, answering common queries and providing instant assistance.

A study shows that firms using AI for client – centric services have seen a 15% increase in client satisfaction levels (SEMrush 2023 Study).

Challenges in Integration

Despite the numerous benefits, integrating AI into day – to – day asset management operations comes with challenges. Ethical considerations, such as algorithmic fairness and transparency, are major concerns. There are also issues related to regulatory compliance, as the use of AI in finance is still being regulated. For example, ensuring that AI – driven investment decisions are compliant with anti – money laundering regulations.

Pro Tip: Establish an internal ethics board to review and monitor the use of AI in your firm to address ethical concerns.

It’s important to note that test results may vary, and the successful integration of AI depends on various factors such as the firm’s size, existing technology infrastructure, and the level of staff training.

Key Takeaways:

- AI offers significant benefits in efficiency, investment strategies, risk management, predictive maintenance, workflow streamlining, and client – centric services in asset management.

- However, integrating AI also poses challenges in terms of ethics and regulatory compliance.

- Asset managers should take proactive steps such as identifying automation opportunities, using AI insights alongside human judgment, and establishing ethics boards to make the most of AI while addressing its challenges.

Try our AI – impact assessment tool to see how AI can transform your asset management operations.

Ethical and Regulatory Guidelines for AI in Asset Management Industry

A staggering number of asset management firms are increasingly turning to AI, with a SEMrush 2023 Study indicating that over 70% of them have plans to expand AI usage in the next two years. This rapid adoption, however, brings to the fore the urgent need for ethical and regulatory guidelines.

Current Related Aspects

Data privacy and market conduct

Data privacy is a cornerstone in AI – driven asset management. As algorithms rely on vast amounts of personal and financial data, protecting this information from breaches is crucial. For example, a major investment firm in 2022 suffered a data leak, exposing client details and leading to significant losses in trust. Market conduct also plays a vital role. Firms must ensure that their AI – based trading strategies do not manipulate the market. For instance, an algorithm designed to front – run trades is a clear violation of market conduct rules.

Pro Tip: Implement strict data access controls. Only authorized personnel should be able to access sensitive client data used in AI models.

Role of regulatory bodies

Regulatory bodies are the guardians of the asset management industry. They set the rules and ensure that firms adhere to them. In the context of AI, these bodies are tasked with creating frameworks that balance innovation with consumer protection. For example, in Europe, the General Data Protection Regulation (GDPR) has far – reaching implications for how asset management firms handle client data in AI applications.

Top – performing solutions include regular audits and consultations with regulatory experts.

Enforcement priorities in US

In the US, enforcement priorities revolve around ensuring fairness, transparency, and accountability in AI – based asset management. The Securities and Exchange Commission (SEC) has been cracking down on firms that use AI in a way that misleads investors. For instance, if an AI model presents overly optimistic projections without proper disclosure of risks, it could face enforcement action.

Try our regulatory compliance checker to see how well your firm measures up.

Future Regulatory Themes

As technology advances, new regulatory themes are emerging. One such theme is the need for explainable AI. As AI models become more complex, it’s essential that regulators and investors can understand how they arrive at their decisions. Another theme is the regulation of generative AI in asset management, which has the potential to create new financial products and services but also poses unique risks.

Firms’ Adherence Principles

Firms should adhere to principles of transparency, integrity, and fairness. They need to disclose how AI is used in their investment processes and ensure that it does not discriminate against any group of investors. For example, a firm using an AI model to screen investment opportunities should ensure that the model is not biased against certain industries or demographics.

Pro Tip: Create an AI ethics board within your firm to oversee the development and deployment of AI models.

Risk Mitigation Strategies

Risk mitigation is key in AI – based asset management. Firms can use techniques such as stress testing AI models to see how they perform under different market conditions. They should also have contingency plans in case of AI system failures. For example, a firm could have a backup manual investment process that can be activated if the AI system malfunctions.

Key Takeaways:

- Data privacy and market conduct are critical current aspects in AI – based asset management.

- Regulatory bodies play a vital role in setting and enforcing rules.

- Future regulatory themes include explainable AI and regulation of generative AI.

- Firms should adhere to principles of transparency, integrity, and fairness.

- Risk mitigation strategies such as stress testing and contingency plans are essential.

FAQ

What is Digital Asset Management (DAM) technology?

Digital Asset Management (DAM) technology is a system that helps organizations store, organize, retrieve, and distribute digital assets. According to industry standards, it streamlines asset handling, improving efficiency. With DAM, firms can manage media files, documents, and more. Detailed in our [Key Technologies Shaping Future DAM in 2025] analysis, AI and blockchain are enhancing DAM’s capabilities.

How to implement advanced data integration in asset management?

Implementing advanced data integration involves a few steps. First, identify relevant data sources for your asset management needs, like market and client data. Second, select a platform capable of handling large – scale data. Third, ensure data security and compliance during integration. This approach, as industry trends suggest, offers a comprehensive asset view. More on this is covered in our [Specific Impacts of Technologies on Digital Asset Management in 2025] section.

AI vs Traditional investment strategies: What are the differences?

Unlike traditional investment strategies, AI – driven ones can analyze vast amounts of data, including market trends and geopolitical events, to identify opportunities. AI algorithms can detect patterns in historical data and predict future price movements with higher accuracy. According to market research, AI – driven strategies have shown an average annual return improvement of 5%. Our [Impact of Increased AI Use on Day – to – Day Operations in 2025] section has more details.

Steps for integrating AI into asset management day – to – day operations?

To integrate AI, start by identifying repetitive tasks, such as data entry, that can be automated. Next, use AI – generated insights to complement human expertise in investment strategies. Also, regularly update AI fraud detection models. As industry – leading tools recommend, this can reduce operational costs. For more, refer to our [Impact of Increased AI Use on Day – to – Day Operations in 2025] analysis.